On one hand, the story of SUNY Oswego’s endowment is one of numbers—how the gifts made from generous donors to the Oswego College Foundation have been wisely managed to support the institution. On the other hand, it is a story of people—how alumni, faculty and friends give generously; how the Foundation Board members, stewards of the fund, manage those gifts, and how Oswego students and faculty members ultimately benefit.

On one hand, the story of SUNY Oswego’s endowment is one of numbers—how the gifts made from generous donors to the Oswego College Foundation have been wisely managed to support the institution. On the other hand, it is a story of people—how alumni, faculty and friends give generously; how the Foundation Board members, stewards of the fund, manage those gifts, and how Oswego students and faculty members ultimately benefit.

Wise Investing, Good Stewardship

Oswego’s endowment stands at more than $15 million dollars, a powerful force for good that benefits the college’s students, faculty and staff in myriad ways every day.

It has grown from $4 million in 2004 — a more than threefold increase — thanks to Oswego’s generous supporters and the wise stewardship of the Oswego College Foundation and its Investment Committee, headed for many years by the late Tom Lenihan ’76.

“State budgets have been plummeting, so for education it is vital that the Oswego College Foundation step up to raise money for those empty spots in the budget every year to maintain a quality institution,” said Dr. Harold Morse ’61 of the foundation board’s investment committee.

Morse added that the endowment provides “additional basic support to everybody at the college through more scholarships, improved facilities, quality faculty and research.”

The foundation’s investment committee members monitor the performance of investment fund managers, manage the asset allocation of the Foundation’s investments, make an annual recommendation of the spending rate, and recommend all changes in investment relations and procedures.

The committee looks at each fund and its long-term spending goal. They consider the need to generate sufficient returns to make the desired annual awards and to keep pace with inflation.

The goal, according to the Oswego College Foundation’s Director of Finance Mark Slayton, is to generate long-term annual returns in the 8 to 9 percent range, since an endowment typically spends 5 percent each year.

“We have been able to do that over a 10-year window,” Slayton says.

Oswego’s 10-year return rate is 8.2 percent—even given the 2008 crash of the financial markets.

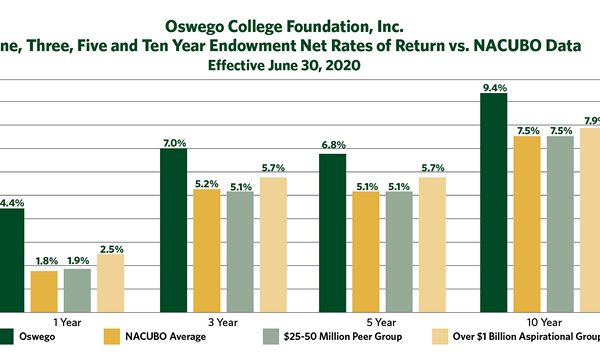

Oswego’s endowment has consistently shown earnings ranking in the top 10 percent of nearly 500 participants in an annual study conducted by the National Association of College and University Business Officers (NACUBO). Of the 493 institutions that reported their 10-year rate of return from the years 2003 to 2012, Oswego ranked 51st, higher than universities with multi-billion dollar endowments such as Princeton and Stanford.

In fact, in eight of the last 10 years Oswego has outperformed the industry average, including the six straight years ended June 30, 2012.

When broken down into smaller time periods, Oswego’s performance is even more impressive. For the last five years, Oswego earned 4.2 percent, ranking 23rd of 666 institutions completing the report, or in the top 3 percent. Three-year data shows Oswego’s increase at 13.5 percent, placing the college 25th of 705 institutions, or the top 4 percent.

“The Investment Committee and Board of Directors took decisive action in the summer and fall of 2008 when the world economy was in a free fall. That’s really the year that set us apart from the rest of the endowment world,” explained Slayton.

Oswego’s loss that year was only 10.9 percent versus an industry average of 18.7 percent, according to the NACUBO report.

But as any successful investor knows, preserving principal isn’t enough. You also need to increase it.

So, as early as November 2008, the Investment Committee began to strategically re-engage the equity markets to take advantage of the recovery. As a result, Oswego’s endowed funds have each now fully recovered and exceed their pre-crash levels.

All Above Water

The other outcome of the Investment Committee’s successful work was in the area of underwater funds. That’s when a fund is underperforming to the point where it is worth less than its original principal.

Half a decade after the stock market crash, many not-for-profits are still struggling with underwater funds. The Oswego College Foundation’s experience with underwater funds was brief and insignificant. The fund has carried no underwater funds at all since 2010.

“The success of Oswego’s endowment is not only due to the prudent oversight of our investments over the years but to our board taking decisive action and doing something unconventional,” said Slayton.

In summer of 2008, Oswego was just coming out of the successful Inspiring Horizons campaign, which raised nearly $24 million to support the college. “We wanted to do everything we could to protect those investments our alumni and friends had made in Oswego’s future,” said Slayton. The board carefully watched the markets and began to reduce our allocation in equities even before the crash of September 2008.

“After much conversation, the board adopted a very conservative approach and it paid off very well for us,” Slayton said.

Honored at the June 2012 Oswego College Foundation board, the late Tom Lenihan ’76 with his wife, Lynn Van Order Lenihan ’76, was recognized for his tireless and astute leadership as chair of the board’s investment committee. The couple generously provided lead donor gifts and support for programs for more than a quarter of a century.

Much of that success was due to the masterful leadership of Tom Lenihan ’76, who chaired the Investment Committee for nearly seven years until his untimely death in March.

Lenihan graduated from Oswego with a degree in economics and computer science. While at Oswego, he met the love of his life, Lynn Van Order Lenihan ’76. They were married in 1976 and have two children, Brian and Colleen.

Tom Lenihan retired from MetLife after 30 years with the organization, having risen to the position of managing director for investment management and capital markets. It was that expertise he put to the service of Oswego’s endowment.

Tom and Lynn Lenihan were steadfast supporters of their alma mater for more than a quarter century. They were lead donors for the Inspiring Horizons campaign, and supported the Campus Center and the Possibility Scholarship program. Tom and Lynn served as Reunion Giving Chair for their 25th anniversary class reunion and spearheaded the revitalization of the college’s reunion giving program, in addition to Tom’s membership on the Oswego College Foundation Board of Directors.

‘Labor of Love’

In June 2012, the Oswego College Foundation board honored Lenihan for his “dedicated steadfast leadership” of the Investment Committee, noting he deserved “recognition and accolades for his tireless efforts.”

“We were privileged to have the benefit of his guiding interest,” said President Deborah F. Stanley. “The future of this institution is stronger and more secure due to Tom’s unwavering commitment to his alma mater, especially as the dedicated steward of our endowment.”

Foundation Board Chairman Bill Spinelli ’84 concurred. “Tom kept a vigilant watch on market conditions, opportunities and challenges to extract the most beneficial position for the Foundation’s investments and assets,” he said.

During his tenure, Lenihan always humbly deferred to his colleagues’ contributions, calling the work of the entire committee a “labor of love.”

“Tom, in his humble way, never accepted personal recognition but would say it was the work of the entire committee,” said Kerry Casey Dorsey ’81, vice president for development and alumni relations and president of the Oswego College Foundation. “But in his sailing vernacular, he was the captain of that ship.”

“Every time the markets dipped or moneys got short, Tom would also give us a great talk at board meetings — how we have this huge responsibility to Oswego to rise to the occasion,” recalled Morse. “Particularly when we had the recession, he led the effort to help prevent any of the scholarship funds from going underwater at that time. He made us feel that we had a responsibility not only to watch everything but also to fix it.”

“The vigilance that he provided in overseeing that everything was all right was outstanding,” added Morse. “I’ve been on several boards and have never seen anyone who was so responsible.”

Lenihan’s “labor of love” stemmed from a genuine affection for his alma mater and its students.

“Tom would say, ‘These are our brothers and sisters and we have to take care of them,’” said Morse. “It’s how we all felt on the board.”

That empathy comes from personal experience. The vast majority of the board members are alumni, and some faced obstacles to fulfill their own educational dreams. They may have worked to earn money for tuition or books, and some benefited from the generosity of donors.

The empathy and commitment the board has for Oswego’s students, coupled with their knowledge of financial markets and their dedication to their fiduciary responsibility to the college are all part of the winning combination the Investment Committee brings to their stewardship of Oswego’s endowment – the art and science of investing success.

—Michele Reed

You might also like

More from Featured Content

Vision for the Future

VISION for the Future Peter O. Nwosu began his tenure as the 11th president of SUNY Oswego, building on the solid …

Envisioning the Potential in All Students

ENVISIONING the Potential in All Students Educator donates $2 million in recognition of his Oswego education, in support of future teachers Frank …

A Vision of Support

A VISION of Support Award-winning principal makes an impact on her school through her positivity and commitment When Nicole Knapp Ey ’02 …